TIMOCOM transport barometer: In search of lost transport capacity

TIMOCOM transport barometer: Freight-to-vehicle-space ratio and forecast for Q4 2024

In contrast to the general recessionary economic situation, trends in the TIMOCOM transport barometer show a high demand for freight capacity in Europe. Freight offer figures in Q3 2024 rose by 90% across Europe, while the number of vehicle space offers generated on the TIMOCOM Marketplace continued to decline.

Demand in Europe almost unchanged

Across Europe, demand for transport capacity in the third quarter remained almost as high as in Q2 of this year (-0.1%). Has the traditional summer slump failed to materialise? Despite the economic downturn? In any case, the number of freight offers on the spot market was significantly higher than in 2023, reaching a peak in September with an average freight share of 81%. In the German domestic transport market, the number of freight offers in the third quarter was 11% lower than in the previous quarter and 66% higher than in the same period of 2023. This is a remarkable development, as the order backlog and business expectations of companies in Germany are in negative territory according to the ifo Institute. In the manufacturing sector, the index has fallen to its lowest level since June 2020. The lack of orders has worsened. This particularly affects the core sectors of German industry, but also the service and trade sectors.

The Polish economy, on the other hand, is developing more positively. According to the European Commission’s spring forecast, Poland’s gross domestic product is set to grow by 2.8% in 2024, almost three times faster than the EU average. The Polish economy has already seen a significant increase in both imports and exports in the second quarter. On numerous routes to and from Poland, the number of freight offers also multiplied in Q3 compared to the previous year. This includes routes to Hungary, the Czech Republic, France and Germany. There was also growth on these routes compared to the previous quarter.

More freight offers on the spot market due to a lack of resources

The lack of resources on the transport market due to company closures and insolvencies, as well as holiday periods, but also the fact that active transport companies have reduced their fleets for cost reasons, means that the demand for capacities is increasingly being sought on freight exchanges via the spot market. ‘Despite the declining order situation in the German economy, the need for transport remains.’ The lost capacity in the transport sector is greater than the economic decline, meaning that demand on freight exchanges remains very high in the third quarter,’ explains Gunnar Gburek, Head of Business Affairs at TIMOCOM. ‘In some sectors, demand for freight capacity can be met with the capacities that are still available, especially where neither certificates nor special equipment are required.’ In sectors that require special equipment, such as cooling units, coil trailers, truck-mounted forklifts or specific licences, there is still a great shortage, and additional capacities are difficult or impossible to obtain.’

Less capacity and fewer new vehicles

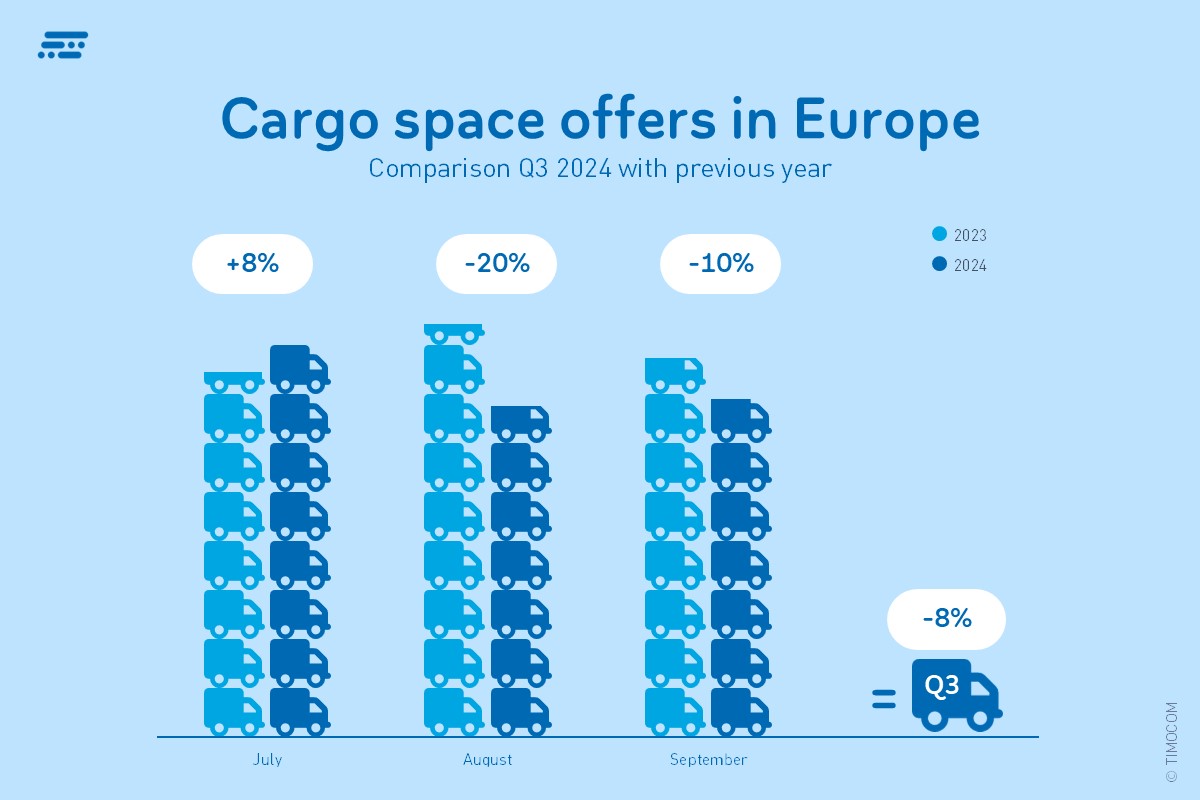

The decline in vehicle space offers on the TIMOCOM Marketplace highlights the lack of freight capacity. Vehicle space offers fell by 8% overall in Q3 compared to the same quarter of the previous year. This reveals a parallel to new registrations of commercial vehicles in the same period. According to the Federal Motor Transport Authority (Kraftfahrtbundesamt, KBA), the number of newly registered vehicles and trailers in the large truck segment fell, particularly for tractor units (Jul. -39.3%, Aug. -69.5%, Sep. -38.2%).

Overall decline in vehicle space offers continues in Q3 2024

Offer prices and price proposals are fluctuating

On the TIMOCOM Marketplace, clients are able to set a price for the offer (offer price) and potential contractors can submit their prices (price proposals). Price developments can be derived from these two alternatives. In Q3, the average weekly offer prices for domestic German transport were between €1.48/km and €1.83/km. The average price in the third quarter was thus up to 14.9% higher than in the same quarter of the previous year. Price proposals also rose in Q3: hauliers demanded average rates of up to €1.91/km in the week with the highest demand.

Taking all European routes into account, the highest average weekly rate was €1.70/km, which is a significant increase compared to the previous year. On average, the price proposals for international transport were at the same level and thus also well above the previous year’s figure.

Outlook: Only a slight decline in freight offers expected between now and Christmas

Although a slight decline in freight offers is expected in the fourth quarter of 2024, transport demand will remain above the previous year’s levels in view of the year-end business. Due to the lack of capacity, the ratio of cargo to vehicle space is expected to average around 78:22 in October and not fall below 70:30 up to and including December (see forecast in the chart). ‘Sources in the consumer goods industry are reporting that, in view of the limited vehicle space capacity available, an exceptionally large run on the free capacities is to be expected on the busy days before Christmas,’ reports Gunnar Gburek.

More information on the current situation on the transport market and the transport barometer can be found here and in the Transport Barometer Report.