TIMOCOM transport barometer: An economic upturn could lead to a shortage of logistics capacity

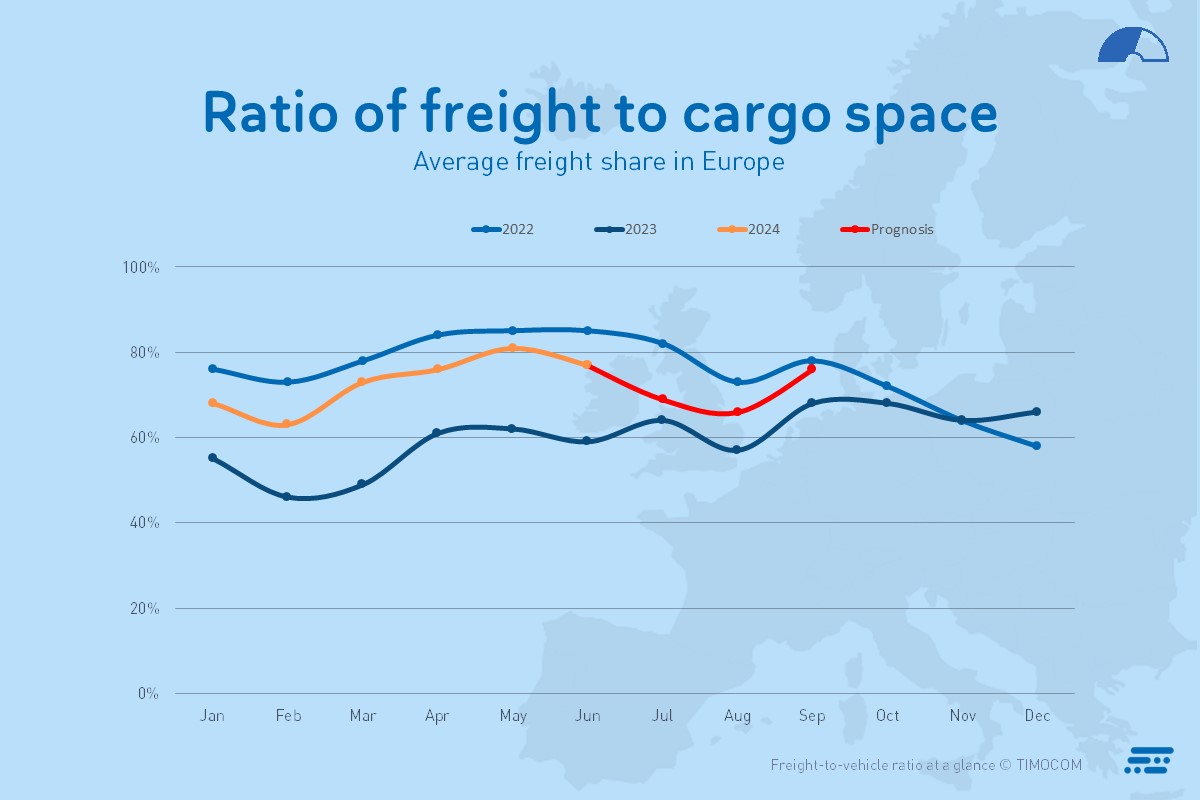

The development of the freight share in Europe

Despite the weak economy and the economic challenges facing Europe, freight offer figures rose in the second quarter of 2024. In the TIMOCOM Marketplace, one of the largest networks for the European road freight market, freight offers were significantly higher than in the previous year.

Across Europe, a total of twice as many freight offers were generated as in the same period of 2023 (+101%) and 53% more than in the first quarter of 2024. As in the previous year, May saw record levels of freight volume (+112% compared to 2023) and reached a new annual high with an average freight share of 81%. The number of freight offers in German domestic transport was 66% higher in the second quarter than in the same quarter of the previous year. The number of domestic offers also rose by two-thirds compared to the first quarter.

The European road freight market lacks the logistics capacity for the increasing number of short-notice transports.

May is a month with a lot of public holidays, and there is always a particularly high transport demand. In order to cope with such peaks, the additional logistics capacity required is sought primarily on freight exchanges. Even shippers and freight forwarders, who normally use fixed transport partners, are increasingly posting transport orders in this situation. ‘The prices offered on a freight exchange are usually more lucrative than the fixed conditions,’ explains Gunnar Gburek, Head of Business Affairs at TIMOCOM. ‘Hauliers are often unwilling to provide their clients with more capacity at the comparatively low freight rates. That is why many clients are now offering their open transport orders on freight exchanges.’

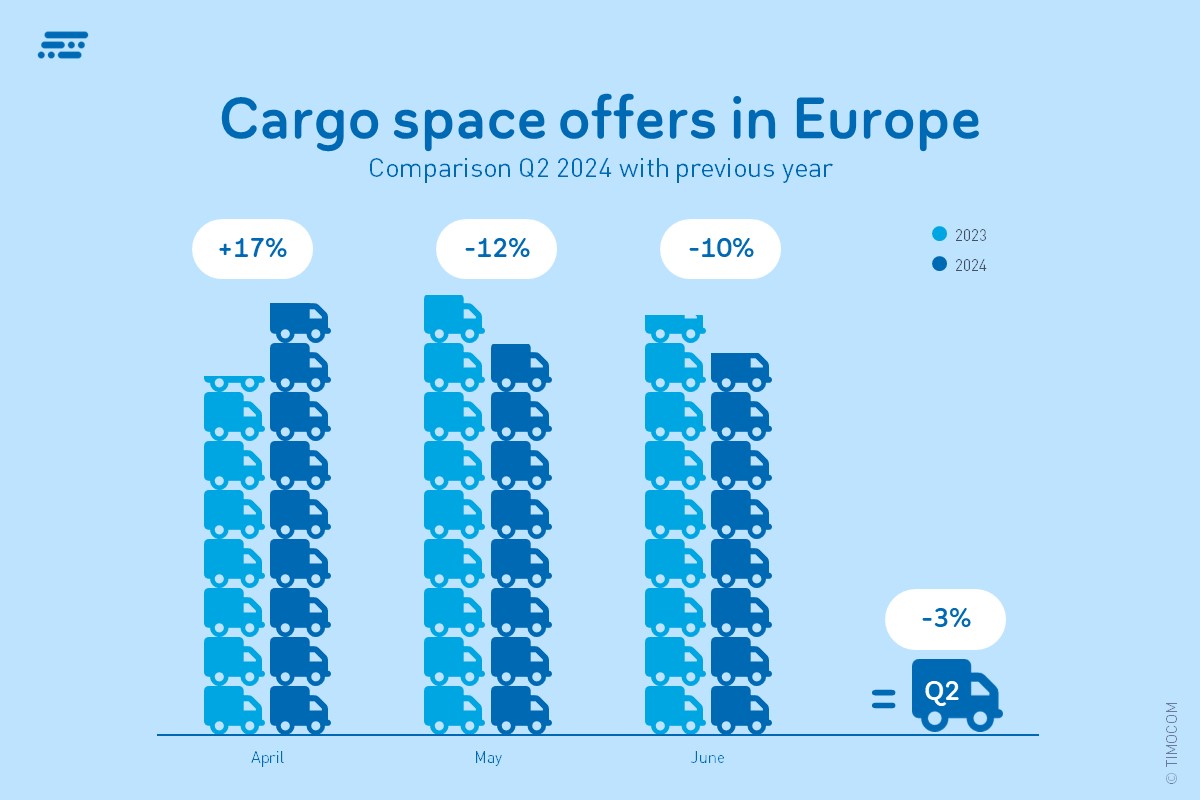

The shortage of drivers and an increase in insolvencies are contributing to logistics capacity bottlenecks and a transport shortage on the market. In the TIMOCOM Marketplace, after a year-on-year decline of 28% in cargo space offers in the first quarter of 2024, a further 3% less truck capacity was posted in the second quarter of 2024 than in the previous year. ‘The current trends in the freight forwarding industry of higher transport demand and rising prices actually encourage hauliers to build up new capacities. However, the poor infrastructure and the unpredictable availability of new drive technologies are causing many to hesitate,’ says Gunnar Gburek. ‘This could lead to a potentially improving economy being held back by a lack of logistics capacity.’

TIMOCOM recommends that shippers set up a closed freight exchange where the additional trips required can be offered. This will then give the connected, fixed transport partners the opportunity to request current market prices for these trips by submitting a price proposal.

Logistics capacity in Q2 2024

Offer prices and price proposals are fluctuating

Within Germany, the average weekly offer prices for freight offers in the second quarter of 2024 were between €1.61/km and €1.83/km, depending on current demand. The average price in the second quarter was 13.9% higher than the offer price in the same quarter of the previous year. By contrast, transport companies’ price proposals in the second quarter showed average values of up to €1.93/km. In weeks with high demand, the price demanded for trips within Germany rose significantly. This is an increase of 17.4% compared to 2023. Supply and demand prices are therefore clearly out of sync. ‘In the end, both parties will probably agree on a compromise,’ comments Gunnar Gburek.

The average offer price for all European routes was €1.60/km. Meanwhile, the price proposals for international transport were on average up to €1.58/km, almost at the level of the offer price. The difference was not so significant here, because longer cross-border routes usually allow a cheaper price per kilometre and the costs for diesel and tolls vary depending on the region.

The highest prices offered were found on routes to the UK: The maximum weekly average prices for transport offers, especially from Switzerland, Italy and France to the United Kingdom, were between €2.34/km and €2.75/km. The additional costs incurred by complicated customs clearance and long waiting times at borders, as well as the difficulty of finding suitable return trips, are major reasons for the comparatively high prices.

Summer slump expected: Decline in freight offers up to and including August

The forecast for the third quarter of 2024 assumes that transport demand will fall. The average ratio of freight to vehicle space is expected to be below 70:30 in the traditionally weaker summer months of July and August. It is only from September onwards that seasonal increases in freight offers will probably be seen again in view of the upcoming Christmas business. The freight share in the TIMOCOM transport barometer could then exceed 75% again and approach the values seen in 2022 (see forecast in the chart).

The development of the freight share in Europe