TIMOCOM transport barometer: Spot market gains in importance due to capacity reduction

After the February low and weak March, is the expected Easter high at risk of falling victim to Trump’s tariff policies?

The freight share in Europe in the annual overview compared to previous years.

The European transport market remains unbalanced. The TIMOCOM transport barometer, which reflects the ratio of freight offers to vehicle space offers, is still well above the 50:50 balance.

After a very strong January with a 75% freight share, the figure fell to 66% in February, which is seasonally weak, and was therefore above the levels of previous years. In March, the figure was only slightly higher, but at 68% remained below the previous year’s figure (73%). This is certainly partly due to the fact that the Easter holidays are not until the end of April this year. Easter was earlier last year, which is why the Easter business started earlier.

Companies are increasingly relying on the spot market

The first quarter saw 30% more freight offered than during the same quarter of the previous year. In Germany, there was an increase of 17% in Q1 (January +46%, February +23%, March -4%). The significantly higher number of freight offers on the TIMOCOM Marketplace shows that companies are still relying heavily on the spot market. This is partly due to the fact that numerous freight forwarders in Central Europe, especially in Germany, have reduced their own fleets but have to fulfil their obligations from fixed annual contracts. This trend is expected to continue, as companies are still very reluctant to invest. According to the SCI logistics barometer, only 7% of German companies are planning to purchase vehicles for long-distance transport. This is not surprising given the stagnating economy and bleak outlook.

Slightly better development in Austria than in Germany

The trend in transport demand in Austria parallels that in Germany, with a higher percentage increase, reflecting the economic cycles in the two countries. In Austria, a total of 24% more freight offers were posted in the first quarter of 2025 than in Q1 2024. In the first two months, there was a significant increase compared to the previous year (January +72%, February +34%), but in March there was a slight decrease of 4% compared to 2024. Here, too, the late Easter business provides a possible explanation. Germany is still the main destination for shipments from Austria, followed by Italy and domestic shipments. In terms of freight offers from Germany, transport to Austria is in third place, just behind France and Poland, but ahead of Italy.

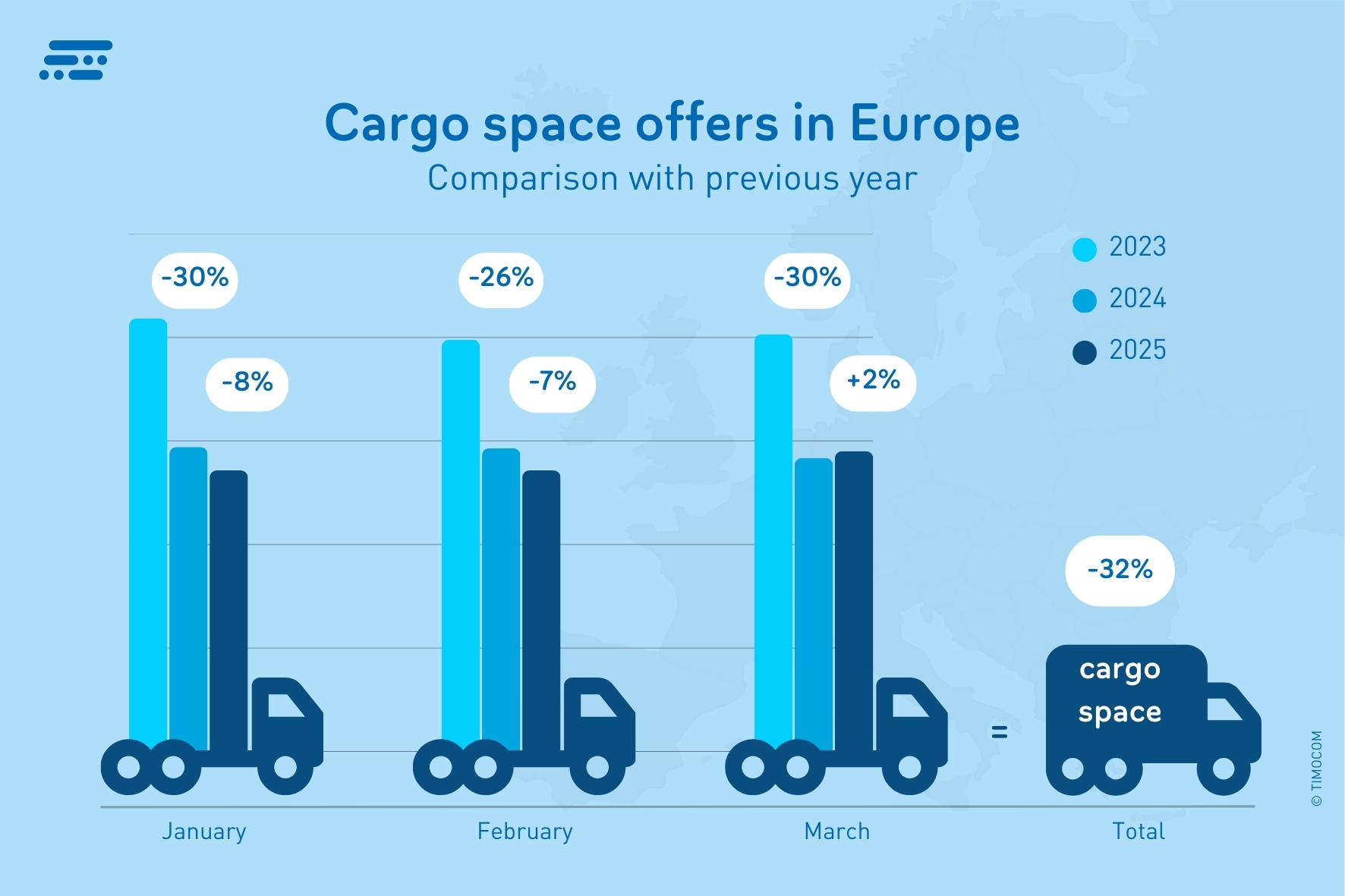

Compared to 2023, the transport capacities offered have fallen by 32%.

32% fewer vehicle space offers than two years ago

Although the available vehicle space posted in the first quarter is only slightly below the previous year’s level, compared to 2023, the figures have fallen by 32%. ‘Due to the high demand for freight space, hauliers appear to be sufficiently busy and do not need to actively offer their free capacities on the market to the same extent,’ reports Gunnar Gburek, Head of Business Affairs at TIMOCOM. ‘However, there are still routes on which the freight share is well below 50% and it is difficult to find suitable return loads.’ For example, there are significantly fewer transport orders from Romania to Germany than the other way around.’

Offer prices and quotes prices rise and fall

In the first quarter of 2025, prices offered for standard transport services, e.g. with a tautliner or curtainsider, fluctuated. On international long-distance routes in Europe, the weekly average was between €1.34/km and €1.55/km, and within Germany between €1.46/km and €1.76/km. In contrast to this, quotes from transport companies ranged from €1.53/km to €1.86/km in Germany and from €1.38/km to €1.54/km across Europe. The price developed over time in line with demand and the need for transport: after the quarterly lows in February, these rose again slightly in March. At their highest point, prices for freight offers in Germany were up to 10% higher than in the previous year, and up to 8.4% higher across Europe.

Taking the mean values of the price ranges in Europe, the prices offered by freight providers are only about 2 cents lower than the mean quotes of transporters, at ~€1.44/km compared to ~€1.46/km. In Germany, the difference is almost 8 cents (~€1.61/km vs. ~€1.69/km). ‘Even though the prices shown here don’t necessarily have to match the actual transport prices agreed, it is clear that the price level in Germany is well above the European average’, says Gunnar Gburek of TIMOCOM, analysing the data.

Outlook uncertain due to unpredictability

In 2025, economic development in the eurozone is characterised by different growth rates in individual countries, with Europe as a whole showing an increase. In Germany, the forecasts are very cautious and speak more of stagnation than of growth, as they do in Austria. Here, the decline in production is as severe as it was in 2020, the year of the COVID-19 pandemic. In addition to industry, the construction and tourism sectors are particularly hard hit.

In view of current discussions on tariffs, however, the economic data for the whole of Europe may still change significantly. According to an analysis by the ifo Institute, President Trump’s new reciprocal US tariffs would probably reduce Germany’s exports to the US by 2.4% if the EU does not take countermeasures. Particularly in Germany and Austria, where exports play a major role, the consequences are unforeseeable,’ says Gunnar Gburek. ‘For us, this means that we have set the forecast for the development of the transport barometer below the previous year’s figures.’

The logistics experts take a similar view in their annual report, in which not all of the tariff announcements could yet be taken into account. In their autmn forecast, the experts predicted that the logistics sector will see nominal growth of 1.3% in 2025, but in real terms it will shrink by 0.1%. However, the growth outlook for the current year has been revised downwards again due to recent developments: a real decline in demand for logistics services of 0.5% to 0.8% is expected. Trading partners such as the US and China will continue to lose relevance and the European and global economies will develop better in the future.

More information on trends in the transport sector and the transport barometer can be found in the Newsroom at www.timocom.co.uk. The latest changes in freight offer figures on selected European routes are also available in the TIMOCOM Transport Barometer Report.