Transport barometer Q4: Analysis of road transport in Europe and forecast for 2024

TIMOCOM transport barometer: Year end review and forecast

There was no drop in demand for transports; the forecast for 2024 predicts that numbers will be higher than the previous year – with one exception.

The fourth quarter of 2023 saw 18% more freight offered than during the same quarter of the previous year. The rise in freight at the end of the year can be attributed, among other things, to an increase in demand, in particular due to seasonal factors, such as Christmas shopping, replenishing inventories and increased consumer activity in the lead up to the holidays. The TIMOCOM transport barometer shows a clear increase in the ratio of freight to vehicle space, due to many carriers reducing their availability.

End of year review showsfewer absolute freight offers

2023 was marked in particular by a significant reduction in the number of freight offers on the spot market. Freight offers dropped by 31% across Europe, and in Germany they even went down 40%. This is an indication that the economic downturn, predicted by many economic institutions from 2023 onwards, has also had an effect on the transport market.

In contrast, transport prices on the German market rose during the fourth quarter. The price for HGV transports were set at up to 10% over those from the previous year, but still lower than peak prices in 2021. A rise in salary and energy costs is the main driver of this development. In addition, carriers reduced the number of trucks they offered for transporting freight in the fourth quarter of 2023 by 15.3% as compared to the same quarter last year. In December this number was even higher, at 21% fewer vehicle space offers than the year before.

Vehicle space trends in Europe, 4th quater 2023

Price trends and an increase in transport demand in spring

According to transport associations, prices for transport will have to rise significantly in 2024. Estimates assume a rise of up to 12%, driven by additional costs, in particular rising toll prices in Germany.

“Many shipping agents don’t think prices will increase by that much,” reports Gunnar Gburek. “They think prices will increase by a maximum of 6%. The difference in these estimates will be a cause of intense negotiations between transport customers and service providers.”

TIMOCOM transport barometer: Year end review and forecast

Number of freight offers expected to be lowest in February

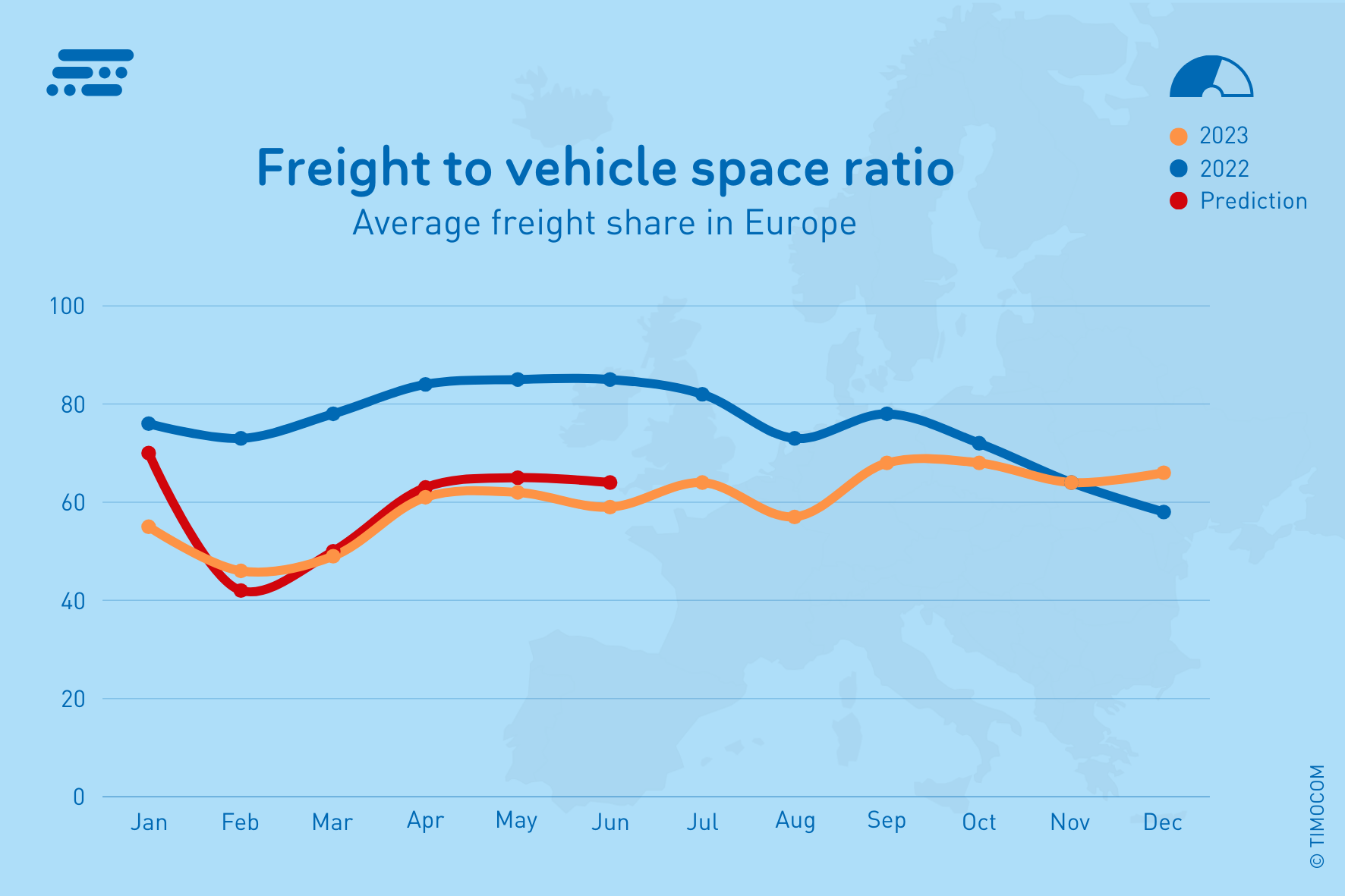

Based on many years of observation and analysis, it is likely that the demand for vehicle space will be higher in January and March 2024 than it was during the same months in the previous year. The lowest freight numbers of the year are predicted for February. This development will be noticeable in almost all European countries, and will increase pressure on the price of freight.

Experience shows that demand for transports will increase in March, causing the number of freight offers to rise once more. By June, the demand for vehicle space could be holding steady across Europe, even exceeding a freight to vehicle space ratio of 60:40 (see forecast graphic). However, it is unlikely that numbers will match those seen in 2021 and 2022.

TIMOCOM’s transport barometer reflects road transport developments within Europe. The data delivers a well-founded overview of current changes on the transport market and provides a realistic forecast for the year ahead.